The Interest Paid on Any Municipal Bond Is

Subject to default risk and is exempt from state income taxation. Subject to default risk and is exempt from state income taxation.

How Do Municipal Bonds Work Learn The Basics

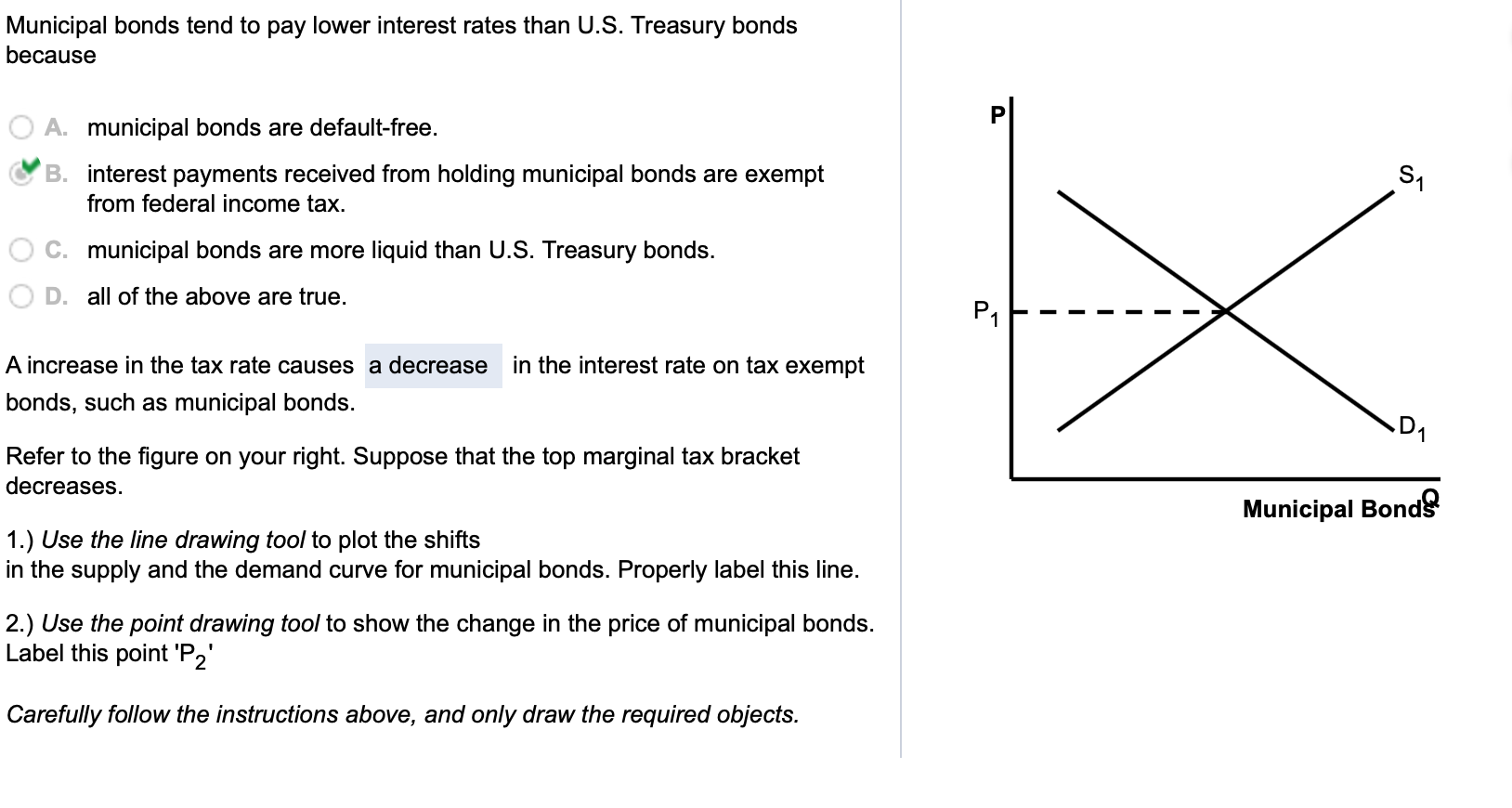

The interest paid on any municipal bond is.

. Even though the interest paid on a municipal bond is tax-exempt a holder can recognize gain or loss that is subject to federal income tax on the sale of such a bond just as. The interest paid on any municipal bond is. You have a choice between investing in general corporate bonds or tax-free municipal bonds.

The corporate bonds yield 7 and the tax-free municipal bonds yield 5. We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Municipal bonds typically carry a call provision.

Exempt from federal income taxation and may or may not be exempt from. Ad Aim To Maximize Income Potential With Municipal Bonds And PIMCO Strategies. It poses a risk to the investor since they will not receive any.

Here the bond quoted at 10273 means the current market price of. Subject to default risk and is exempt from state income taxation. Usually the interest is paid within 6 months until the due date comes.

The government is required to pay back the principal and the interest due on these bonds. Fed hikes arent necessarily bad news for. While bond math doesnt lie its not the whole story.

Here are three facts that could change your thinking about municipal bonds and rising rates. Free of default risk. The interest paid on any municipal bond is.

Explore How Full Active Management Can Add Value. Ad We Offer Over 70 Funds With 4 5 Star Ratings From Morningstar. More Varied Credit Quality.

The interest may also be exempt from state and local taxes if you reside in the state where the. Generally the interest on municipal bonds is exempt from federal income tax. Ad The Muni Market Has Transformed.

25 A bond quote is the last price at which a bond traded current market price expressed as a percentage of par value. Seek To Enhance After-Tax Income Potential With PIMCO Muni Resources. A call provision allows the issuer to redeem the bond before the maturity date.

For example if you invest 5000 in a 10-year municipal bond paying 4 interest youve loaned 5000 for 10 years. More Varied Credit Quality. The interest rate of most municipal bonds is paid at a fixed rate.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. In return the municipality will pay you 200 annually in. Free of both default risk and federal income taxation.

In general interest paid on municipal issues is exempt from federal taxes and. Explore How Full Active Management Can Add Value. This rate doesnt change over the life of the bond.

However the underlying price of a particular bond will. Lets get started today. Free of both default risk and federal income taxation.

The interest may also be exempt from state and local taxes if you reside in the state where the bond is issued. Municipal Bonds Munis are interest-bearing debt obligations issued by a state or local municipality. Ad The Muni Market Has Transformed.

Ad Were all about helping you get more from your money. The interest paid on any municipal bond is. O free of both default risk and federal income taxation.

O taxable at the federal level and tax exempt at the state and local level O. Generally the interest on municipal bonds is exempt from federal income tax. Municipal bonds are one of the safest investments you will find with an average default rate of 008 between 1970 and 2019 according to an annual study by Moodys credit.

Free of default risk. - Interest paid by the municipality is subsidized either by the Federal Government paying back the municipality 35 of the interest paid out or bondholders may take a Federal tax credit equal to. On the due date the face.

What Are Municipal Bonds And How Do They Work Thestreet

Sec Gov What Are Municipal Bonds

Solved Municipal Bonds Tend To Pay Lower Interest Rates Than Chegg Com

/GettyImages-656680302-b9ac142099da451e8fa31a60d9fa9a33.jpg)

No comments for "The Interest Paid on Any Municipal Bond Is"

Post a Comment